Encourage tax credit take-up now

June 01, 2016 –

In the February edition of Benefit magazine I discussed the effect of the cut in the Universal Credit (UC) ‘work allowance’ on incentives to enter work, compared to the original incentive structure of the benefit, and the effect of the cut on the comparison between UC and tax credits.

In terms of incentives, the effect of the cut is that the amount of in-work support for low earners under UC will now be significantly lower than it would otherwise have been – there is a smaller ‘top-up’ for people on low pay. This is the policy intention, and the introduction of the higher ‘living wage’ is meant to compensate. However, until the living wage rises significantly more, better-off-in-work calculations for UC now show smaller gains than under the benefit’s original structure.

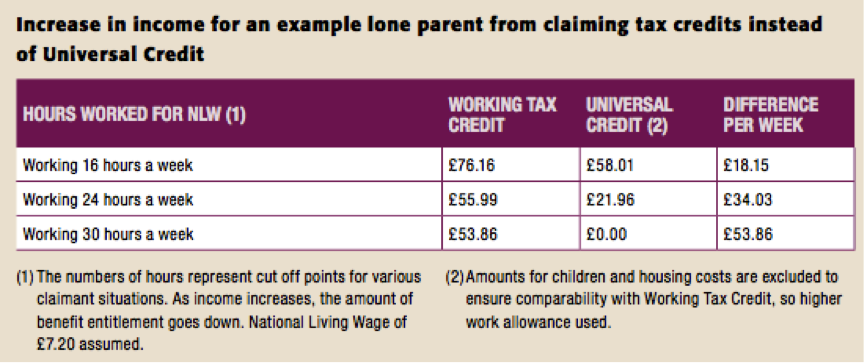

The effect of the cut in the work allowance on the comparison with tax credits is more important in terms of its implications for local authorities. As discussed in February, the cut to the work allowance, combined with the reprieve for tax credits announced in the Autumn Statement, means that for low earners who are eligible the amount of help received through Working Tax Credit is higher than UC. The table below uses a low earning lone parent as an example of how large the effect can be in some cases.

Another way of looking at the effect of the cut is where it leaves the overall picture of whether people are better or worse off under UC. When UC was introduced, the government estimated that there would be roughly equal numbers of winners and losers from its introduction. However, according to the Institute for Fiscal Studies1, the work allowance cut means that more than a million extra people will be worse off under UC, compared to those who gain. Well over 40% of people will now lose out under UC, relative to their current benefit entitlement.

The fact that low income workers are generally better off claiming tax credits than UC should in any case provide a powerful reason for local authorities promoting tax credit take-up. But it has particularly important implications for those councils that are part of the roll-out out of the UC ‘digital service’, the new computer system for delivering UC piloted in Sutton and now being rolled out nationally. Unlike the previous extension of UC to clearly identified groups (in most areas single, unemployed people making a new benefit claim), the digital service means all new claims and changes of circumstance must be made to UC. This means that once the digital service is rolled out in your area, your working age residents will no longer be able to apply for tax credits. It is therefore essential that residents are encouraged to make new claims to tax credits now before it is too late.

Nationally, around one million people entitled to Working Tax Credit do not claim it and on average they lose £1,600 per year2. If everyone who is entitled were to receive that £1,600 average award, the effect would be an extra £1.5 billion per year coming into the economy.

As well as increasing their income now, people on tax credits could also preserve those higher incomes for years to come, even after moving on to UC. This is because of transitional protection, the government’s commitment that “no-one will be worse off under UC”, which applies as long as claimants don’t have a significant change of circumstance. Transitional protection could amount to more than £300 a month in some cases and this protection could last many years.

It is not just individual residents who stand to gain from applying for tax credits now. For councils, the introduction of local council tax reduction (CTR) schemes gives a vested interest in ensuring the highest possible incomes for the greatest number of your residents. As any increased income for individuals means lower CTR, so the imperative for increasing take up of tax credits is great. As we have already seen, tax credit awards can be substantial, which means significantly lower expenditure on CTR. And with transitional protection in place, this lower expenditure could remain for a substantial period once they are migrated on to UC.

The content in this blog was published in the June 2016 edition of Benefit magazine.